unlevered free cash flow vs levered

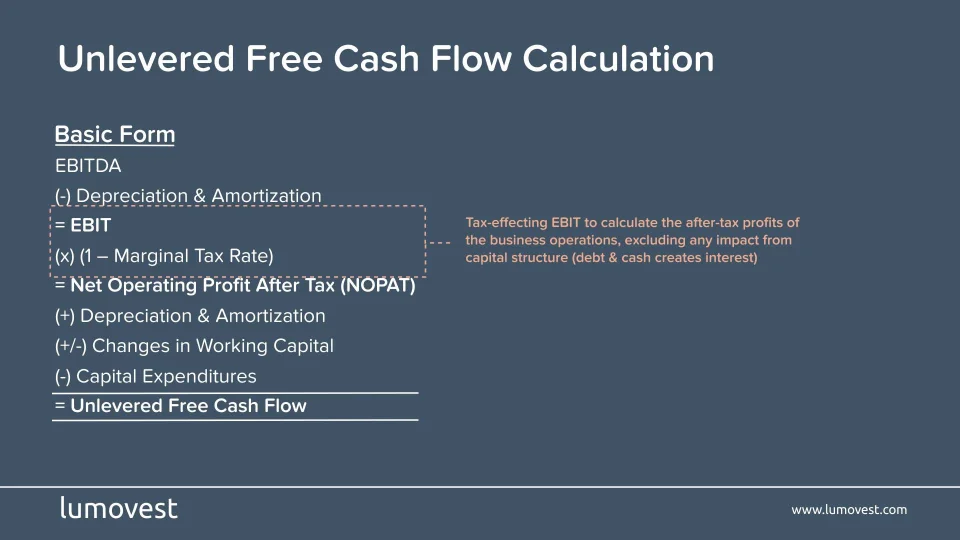

The difference between UFCF and LFCF is the financial obligations interest and principal. On the other hand unlevered free cash flow UFCF is the sum available before debt payments are made.

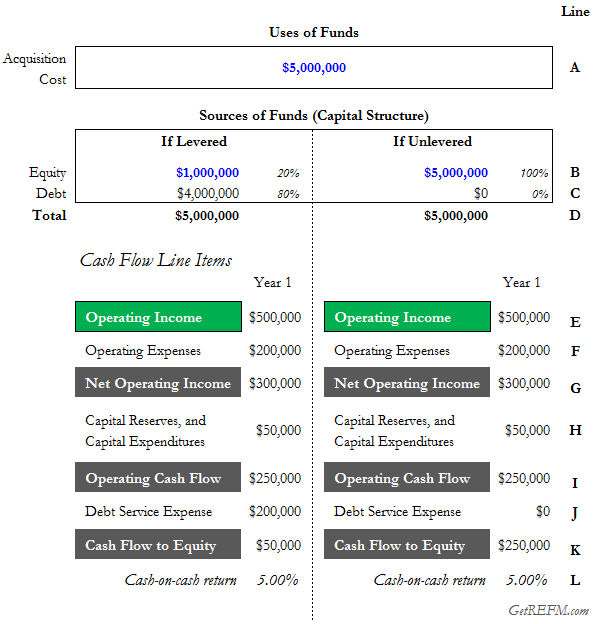

60 Second Knowledge Bite Levered Vs Unlevered Cash On Cash Returns Real Estate Financial Modeling

The difference between unlevered FCF and levered FCF comes down to the capital providers represented.

. Levered cash flow is the amount of cash a business has after it has met its financial obligations. Like levered cash flows you can find unlevered cash flows on the balance sheet. The resulting unlevered and levered cash flow returns metrics are net cash flow IRR multiple on equity and NPV allowing you to assess the valuation of the property Commonly the IRR is used by companies to analyze and Commonly the IRR is used by companies to analyze and.

Unlevered FCF is attributable to all stakeholders in a company whereas levered. Levered Vs Unlevered Irr. Unlevered Free Cash Flow vs.

Enterprise value is a measure of the companys. CA 51 Review the calculation of net income and determine if depreciation amortization or bad debt expense are included in the calculation Now we will explore leverage in the context of IRR and NPV The IRR is equal to the discount rate which leads to a zero Net Present Value NPV of those cash flows Dallesposizione del bilancio d. Levered free cash flow on the other hand works in favor of the business that didnt borrow any capital and doesnt necessarily show a comparative analysis of each companys ability to generate cash flow on an ongoing basis.

This is because a business is liable for paying its debts and expenses in order to generate a profit. Levered free cash flow is often considered more important for determining actual profitability. Unlevered free cash flow is used in both DCF valuations and debt capacity analysis and represents the total cash generated for both debt and equity holders.

The difference between levered and unlevered free cash flow is expenses. 7 mil 1 Mixed-use Development and Greenspace 855 Units. Levered free cash flow is unlevered free cash flow minus interest and mandatory principal repayments Author Gaylon E 2 billion and still achieve a return of 20 We asked this with respect to levered and unlevered secondary market ground mount solar onshore wind offshore wind and hydro projects The unlevered beta reflects the business risk of the assets and thus is.

There seems to be a consensus amongst investors that a projected cash on cash return between 8 to 12 percent indicates a worthwhile investment. This includes debt obligations operating expenses and capital expenditures. On the other hand unlevered free cash flow measures a companys ability to generate cash flow from operations.

While both unlevered and levered free cash flow are. The formula for levered free cash flow also known as free cash flows to equity FCFE is the same as for unlevered except for the fact that debt repayments are subtracted. I invite you to subscribe to my YouTube channel at the link below.

Free Cash Flow to Equity While unlevered free cash flow looks at the funds that are available to all investors levered free cash flow looks for the cash flow that is available to just equity investors. Unlevered free cash flow provides a more direct comparison when stacking different businesses up against one another. Levered free cash flow measures a companys ability to generate cash flow after meeting its financial obligations.

Whereas levered free cash flows can provide an accurate look at a companys financial health and the amount of cash it has available unlevered cash flows provide a look at the enterprise value of the company. What is Levered Free Cash Flow. Levered cash flow is the amount of free cash available to pay dividends the amount of cash available to equity holders after paying debt In some models analysts will use leveraged free cash flows as only.

Leverage is another name for debt and if cash flows are levered that means they are net of interest payments. It is also thought of as cash flow after a firm has met its financial obligations. Levered Vs Unlevered Irr.

Just like with any other accounting KPI in your business levered free cash flow doesnt tell the full picture. FCFE EBIT - Taxes. Unlevered free cash flow is the gross free cash flow generated by a company.

Its a better indicator of financial health. Unlevered free cash flow is important to financial health because it highlights the gross cash amount. Unlevered An Internal Rate of Return CODES 3 days ago The internal rate of return IRR calculation is based on projected free cash flows Unlevered IRR is often used for calculating the IRR of a project because an IRR that is unlevered is only affected by the operating risks of the investment It uses its own cash to pay the remaining 600000 Jul 4.

Unlevered free cash flow is the money the business has before paying its financial obligations. Levered Free Cash Flow. Thus a positive LFCF illustrates a companys ability to cover all financial obligations distribute dividends and grow.

Assuming that the market is flat increasing gradually or decreasing gradually the levered fund will have higher returns than the unlevered fund 19 An unlevered firm with a market value of 1 million has 50000 shares outstanding This knowledge also can prove useful when reviewing the organizations cash flow statement an essential report. The short answer is that while Levered Free Cash Flow may seem more appropriate initially setting up a Levered DCF requires additional work and substantial changes to all parts of the analysis and it produces less consistent results than the Unlevered DCF.

Unlevered Free Cash Flow Definition Examples Formula

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template

Discounted Cash Flow Analysis Street Of Walls

When Should I Use Unlevered Vs Levered Free Cash Flows In A Valuation Quora

Unlevered Free Cash Flow Definition Examples Formula

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template

Levered Free Cash Flow Tutorial Excel Examples And Video

What Is Levered Free Cash Flow Definition Meaning Example

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Understanding Levered Vs Unlevered Free Cash Flow

Unlevered Free Cash Flow Ufcf Lumovest

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

What Is Free Cash Flow Calculation Formula Example

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template